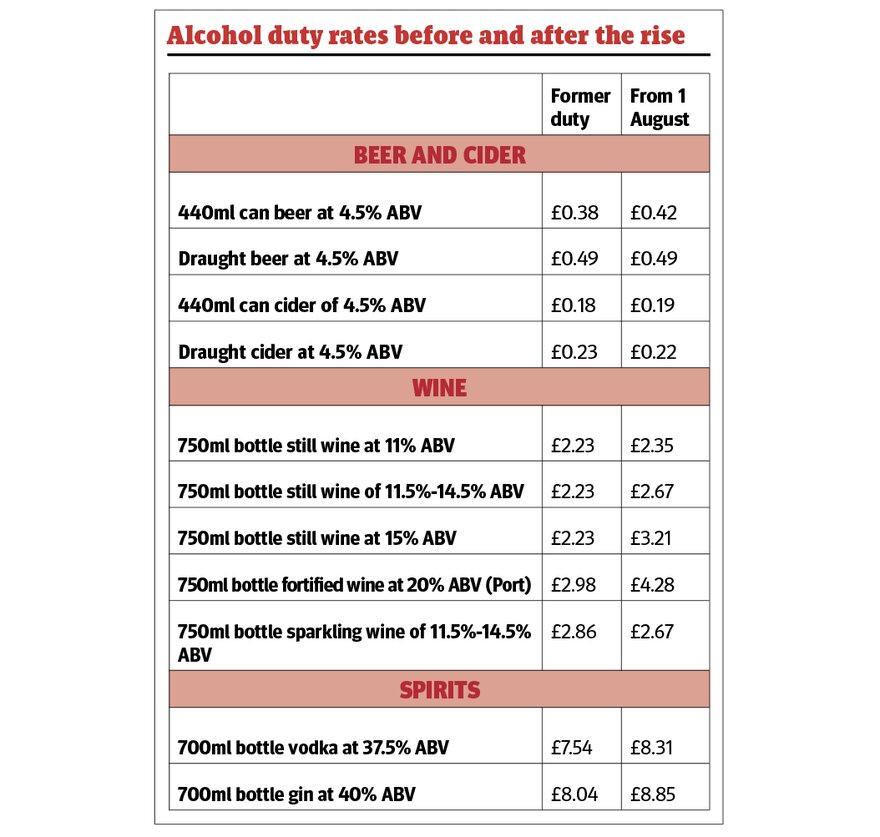

A complete reworking of the alcohol duty system has seen alcohol taxed according to strength. Do the new rules benefit hospitality?

In the lead up to the sector's summer months, operators have been readying themselves for an uplift in trade. But they've also been readying themselves for another type of uplift: the introduction of the new alcohol duty rates, which came into effect on 1 August.

Chancellor Jeremy Hunt in his Spring Budget announced the end of the freeze on alcohol duty (which began in autumn 2020), which has been dubbed the biggest change to the alcohol tax system in 50 years.

What came instead was a complete reworking of the duty system. Previously alcoholic drinks were taxed based on the category they fell into: beer; cider and perry; wine and made-wine (such as mead); or spirits. The higher the alcohol by volume (ABV), the higher the new duty rate is, and these increases are determined in line with the Retail Price Index.

UKHospitality chief executive Kate Nicholls explained: "The duties are a tax on production but that gets passed down the supply chain and taken into account when prices are fed by manufacturers, wholesalers and suppliers into the hospitality trade. You're seeing, across the board, price increases of between 13%-18% – that's the average. That's not just for duty, but duty is reflected in that."

Pint pulling relief

The government has been keen to state that the new system is "protecting the price of your pint". But is this true?

Under Hunt's ‘Brexit pubs guarantee' he introduced draught relief, which aimed to ensure draught pints in pubs were cheaper than the supermarket-bought alternative, to encourage consumers to drink in pubs and bars.

Draught relief was increased from 5% to 9.2% for qualifying beer and cider products, which in effect translates to a duty freeze. However, the British Beer & Pub Association's chief executive Emma McClarkin explained that this is not the complete picture. She said: "People hear the word ‘freeze', and it sounds really good. But overall, for breweries, this is an overwhelming duty increase."

She added that because relief was not being offered on other products, such as packaged beer and brewed products above 8.5% ABV, the brewery sector would still see its tax burden increase by an additional £225m a year, a cost that will be passed on to the businesses buying products.

McClarkin added that, even if duty cuts were to be passed on, it was unlikely they would have the intended impact when it came to protecting the cost of a pint served in a pub. With operators and producers facing sharp cost increases across the board, many of which have been absorbed, it seems very unlikely that prices would be lowered.

Supporting small businesses

The government is also replacing the small brewery relief scheme with a small producer relief scheme. This is aimed at those who produce 450,000 litres or less a year, measuring less than 8.5% ABV, and not solely beer.

The change is good news for expanding brewers as previously the cap was judged on the amount of product produced. McClarkin said it was "in some ways holding brewers back, because there was such a cliff edge when it came to growth". She added that the shift "will help brewers across the board in producing beer in growing volume, and hopefully that will mean that we can keep that range and breadth of choice."

No- and low- innovation

The change to make alcoholic strength a determining factor in duty rates was also expected to see an expansion in the range of no- and low-alcohol products on the market. McClarkin said: "The government is incentivising brewers to [produce] lower strength beers, enabling us to help people moderate or lower their consumption of alcohol. It is a positive thing; it is a growth market for the industry and it's a really exciting category."

Not all rosé

While there are consoling factors for the beer and cider sectors, the Wine and Spirits Trade Association (WSTA) has expressed concerns for the wine and spirits industry.

Although lower to mid-ABV still wines (11.5%-14.5%) are being given a grace period until 1 February 2025 (in the interim, wines of that strength will taxed as if they are 12.5% ABV), Nicholls said operators would be "scrutinising" their wine lists and, in all likelihood, opting to feature more lower ABV wines.

This is the case with Sunny Hodge, founder and owner of London wine bars Diogenes the Dog in Elephant and Castle, and Aspen and Meursault in Battersea. Hodge said he has been "more proactive than ever before in re-costing our wine lists". He said prior to the pandemic his efforts went into sourcing various brands of wine with the financial side coming second, but now, he said, he is "much more strategic" in his approach to his menu.

While he will not add more lower-strength wines onto his wine list, he said the duty change will result in the sector "more broadly taking that direction".

In a bid to save costs, he is importing directly from wine-makers, "easily three to four times more than ever before […] that has enabled us to get wine at a cheaper price and cut out the middlemen". He added this isn't feasible for all operators because of the time, storage and cash-flow implications, but for smaller businesses such as his, it's more cost effective.

For higher ABV products, such as port and sherry, the duty rate has increased by a third to almost half, which Hodge said was a "crazy amount". This sentiment is echoed by industry bodies; earlier this summer, Martin Beale, chief executive of WTSA, spoke of the "punishing duty rises facing the fortified wine sector".

For most spirits where strength exceeds 22% ABV, the inflationary uplift was 10.1%. A UK Spirits Alliance spokesperson said: "This tax hike is not just shortsighted, but is actively damaging to pubs, distilleries, and the hospitality sector.

"With the 10.1% hike in spirits duty – the highest since 1981 – the chancellor has failed to reflect the popularity of the diverse modern hospitality industry, driven by the growth in innovative British products, such as those created by the small distillers within our membership."

‘Double-edged sword'

The government changing alcohol duty is not new, but what is new is the substantial impact it now has on all alcoholic products.

According to Nicholls, this duty "is more significant than most because it's not just an annual duty change, it's also a change in the structure of the way that duty is applied, which impacts a broader range of products".

While McClarkin said this duty was "fairer and more progressive", and one which benefited lower alcohol products, such as beer, she also warned it is a "double-edged sword".

While the government's objectives "sound good", she questioned, "the reality is can people afford to go out? Can they see a difference?" Citing extreme cost inflation on food, drink, energy and staffing, which are often either absorbed by the operator or partly passed onto the consumer, McClarkin remained uncertain whether the new system would actually drive people back to pubs.

Hodge said: "The fact is that the timing is rubbish because inflation affects everybody. The staffing crisis is very real, so the cost to operate is higher than ever, and bringing in this type of change only damages us."

He added: "It's a big shake-up. Some people will be happy, but for many others, that won't be the case."

Will mead rise in popularity?

Tom Gosnell, founder of Gosnells' is hopeful for the future of mead. He said: "The duty on a pint of draught mead will fall from 52p to 43p, due to the introduction of the new draught relief, bringing it in line with beer. This saving should allow the burgeoning mead sector to invest in itself."

Mead had previously been included in the ‘made wine' category, so the reform of the duty system is a boon.

Gosnell added: "Previously mead was taxed the same, whether at 6% ABV and 15% ABV, effectively making anything at around 8% commercially difficult [as consumers tend to align ABV with what something should cost]. As duty will now increase proportionally with ABV, we are free to experiment and innovate across a range of strengths, better reflecting the drinks we want to produce."

The producer hopes the changes will help diversify the drinks market, as was seen in the craft beer boom. He said: "Gordon Brown was certainly responsible for some of the success of craft beer. In 2002, he introduced the small brewers' tax relief. This relief enabled small breweries, employing lots of local labour and often selling locally to compete more effectively against the multinationals with the latter's economies of scale.

"It's in the spirit of this that the government has approached this duty reform."

Continue reading

You need to be a premium member to view this. Subscribe from just 99p per week.

Already subscribed? Log In