In a cost of living crisis, money people do spend is more precious. We explore research from The Caterer and CGA on how consumers are driving operators to more experiential business models

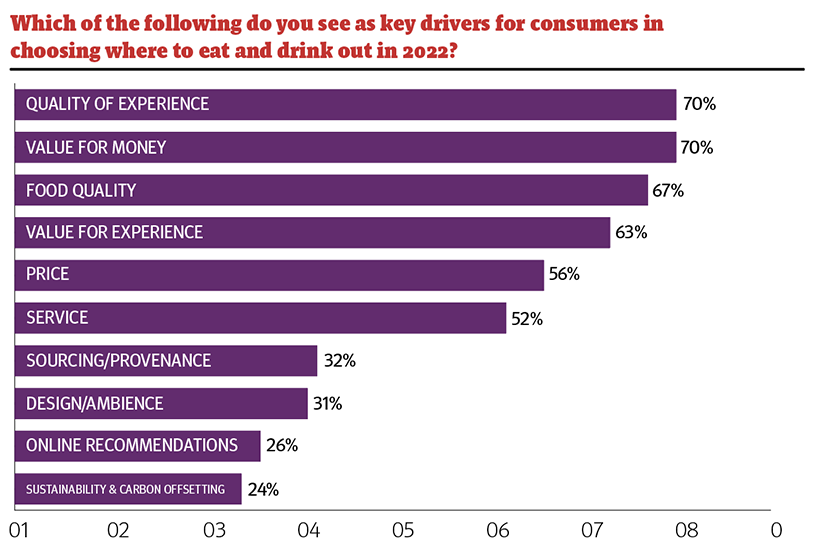

Unsurprisingly, amid a cost of living crisis, today's consumers are looking for value for money. The Business Leader's Survey 2022, produced by The Caterer and CGA, revealed that operators believe the biggest driver for consumers choosing where to eat and drink out for the rest of this year will be centred around getting their money's worth, which is up 25 percentage points versus this time last year.

The autumn of 2021 was a completely different landscape, and while the quality of experience is still important to customers, value for experience is also gaining traction as they decide where to spend their hard-earned cash.

Unfortunately, for the environment, only 24% of respondents believed consumers would be driven by an operator with high sustainability credentials, compared to 63% stating value for experience, 67% pointing to food quality and 70% seeing value for money as a key driver.

Indeed, experiences such as tasting activities, live music, brand takeovers, kitchen pop-ups and ‘meet the brewer', were all listed as considerations to tap into the continued consumer demand for value-added extras.

Hotel operators agree that quality and value of experience will be important to consumers, but think food quality will be of less importance, preferring to focus instead on higher-value rooms to drive growth. Ted Mulcauley, senior insight consultant at CGA, said cost of living is top of mind for everyone – both operator and consumer alike. "There's a deep concern around the cost of living and people are worried about the future. That said, while there is this concern, people aren't fundamentally changing their habits in a drastic way, and the apocalyptic scenario of millions of people stopping going out hasn't happened. Sales are actually stable, but inflation is eating into operators' profits."

Karl Chessell, director, hospitality operators and food, EMEA at CGA, added: "For consumers, it's not price that's the driver here, it's value – they're not looking to spend less, but they do want good use of their money."

Watching the pennies

According to the research, most business leaders (83%) expect a drop in the frequency consumers choose to drink and eat out in the coming months, while over half (56%) are expecting a drop in average spend. This is where the experience element becomes even more important, according to Chessell: "This squeeze on wallets could lead to consumers dropping mid-week occasions, but they'll still want to go out at the weekend – a customer who normally drinks premium larger isn't switching to a standard pint. If they have £50 left to go out, they're thinking carefully about how to use that money. They're not necessarily looking for cheap and cheerful and they still want a reason to get off the sofa."

He added: "In good times you can get away with being below average, but now people are looking for value for money and operators may look to upsell bundles rather than discount, such as bottomless brunches, which have a perception of value."

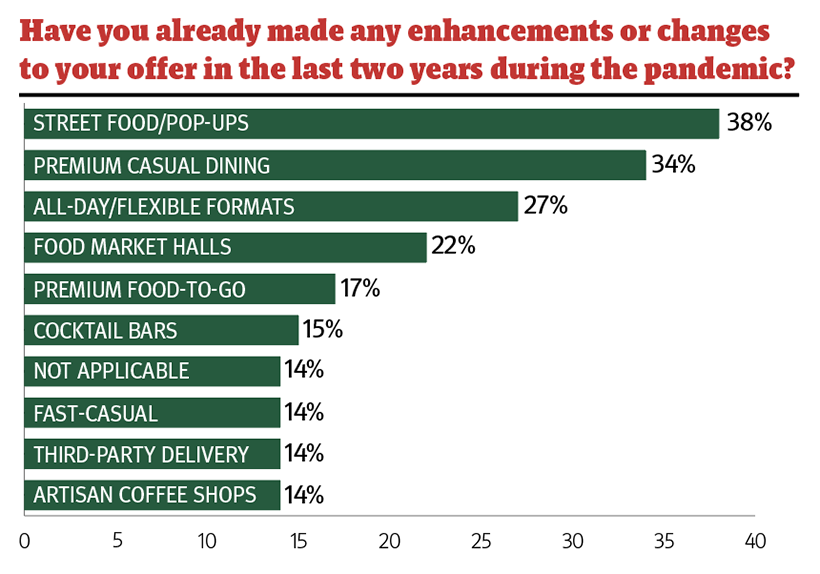

The way operators have changed or enhanced their businesses over the course of the pandemic may see them best-positioned to weather the storm. The survey reported a boom in street food and pop-ups (38%), while market halls also proved popular (22%), while fewer operators enhanced their offers with artisan coffee shops (14%) and cocktail bars (14%).

The street food and market halls concepts offer customers experience-led dining while embracing efficiency, one of the key growth opportunities for business leaders, with 48% looking to prioritise this in the near future. Premium food (38%) and drinks (25%) are further down the list of priorities.

"Street food and market hall concepts offer variety and unusual cuisines – each visit feels a bit different and there is usually a buzz about them," explained Chessell. "These concepts, as well as competitive socialising models like Flight Club and Swingers, are thought of as efficient operating models as they don't need a lot of staff and technologies such as order and pay work well here without affecting the experience."

Mulcauley explained that while the industry is still battling with the staffing crisis, these types of hospitality models can function with fewer staff while maximising profit when margins are being squeezed.

Sites in sight

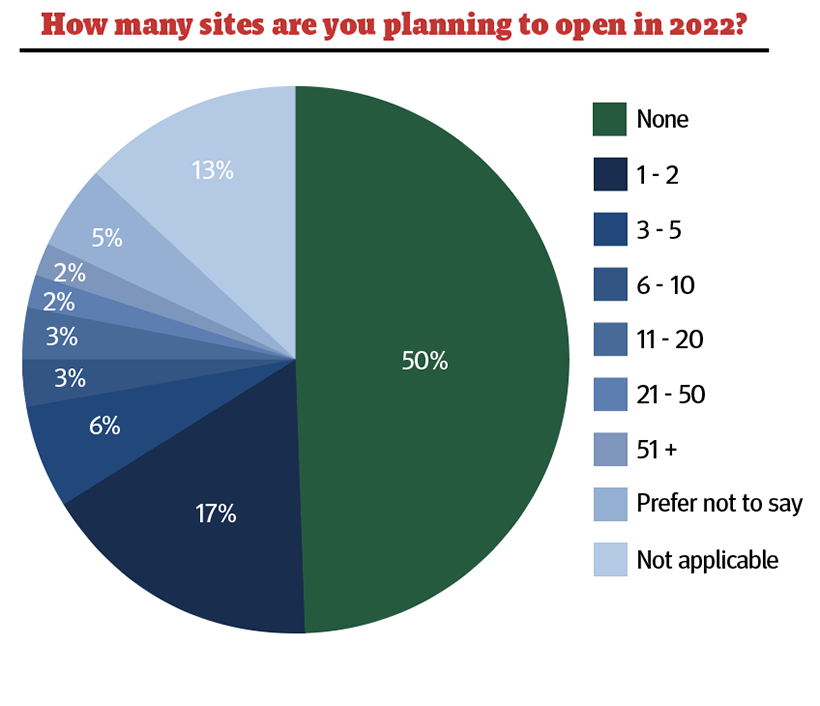

The research revealed that the average number of sites leaders plan to close this year is 0.4, with 70% of operators planning to close no sites and 9% planning to close 1-10 sites. On the flip side, the average number of sites leaders are planning to open this year is 3.2, with half of respondents planning to open no sites, 22% planning to open between one and five sites, and 10% looking to open over six.

It's the larger operators who have the most ambitious plans, with 68% of those with 11 sites or more already planning to open further sites. While these figures are hopeful, it's important to remember in this rapidly changing landscape cost pressures have worsened in the six to eight weeks since respondents were questioned over the summer of 2022.

Christie & Co's managing director of pubs and restaurants, Stephen Owens, said while operators may have plans to open new sites, the problem recently has been the lack of stock on the market. "While some purchasers are anticipating an impact on trading performance with increasing costs and a talk of a recession, this hasn't yet fed into the transactional [property] market, because there hasn't been a huge amount of property available, so there are a smaller number of opportunities.

"The market has polarised: consumers want value, but they also want experience, and if you're not offering one or both you'll be finding it fairly tough."

Pointing to the larger properties which may suit a market hall-type offering, he added: "We're seeing interest in the premium end of the market which can deliver that experience for consumers and demand for those sorts of assets is strong and there's not a lot of supply."

Owens remains fairly hopeful for the coming months, noting how customers are thinking about what is important to them, especially with pressures on discretionary spend. "People will still prioritise spend on hospitality, but probably less frequently and more on premium experiences," he said.

Business Leaders report 2022 The Caterer and CGA interviewed more than 500 top industry bosses from across the restaurant, hotel, foodservice and pub & bar sectors. They were asked on their confidence in the market, how their business is performing, their priorities for the year ahead, trends they're experiencing and the biggest challenges and opportunities for their business. Their views have been compiled and analysed to show the true picture of what's happening in hospitality and what any business can learn from it.

Continue reading

You need to be a premium member to view this. Subscribe from just 99p per week.

Already subscribed? Log In